One of the major benefits of implementing Quality Management Systems and maintaining ISO Certification to relevant Standards, is that these systems include frameworks for risk management. Business risks are evolving by nature, so keeping your risk mitigation strategies up-to-date is essential.

One of the most effective risk mitigation frameworks outlined in the core ISO Standards is the application of risk assessment matrices. Below, our ISO consultants at S&J Auditing & Consulting will be outlining exactly what a risk assessment matrix is, how it supports sustainable, ongoing risk management for businesses of all sizes, and how you can use risk assessment matrices and registers to maintain ISO compliance for your organisation.

Download our Risk Assessment Matrix Template

To help you better understand this overview of risk assessment matrices, we’ve prepared a sample risk assessment matrix and risk assessment register in PDF format for free download.

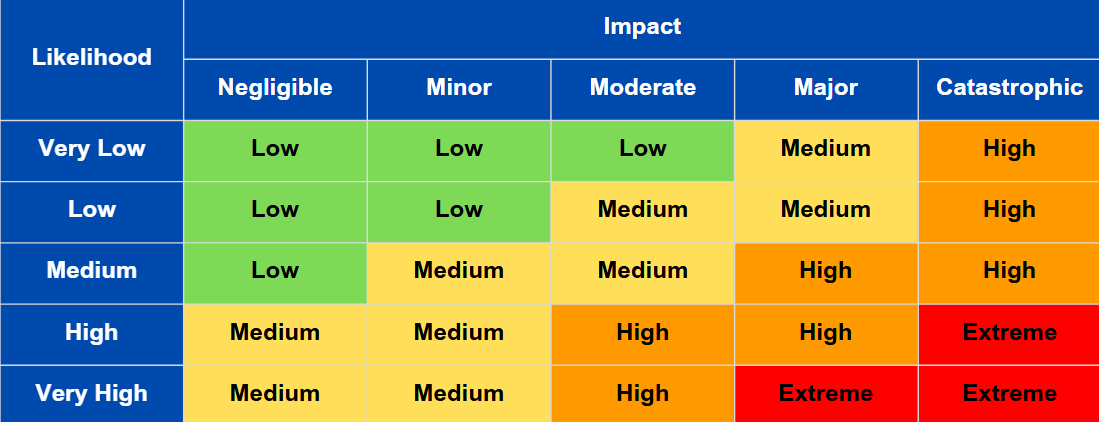

Refer to this risk assessment matrix and accompanying risk assessment register showcasing matrix evaluations in action when creating your own risk management systems for your organisation.

What is a Risk Assessment Matrix?

A risk assessment matrix (also often referred to as a Likelihood and Impact risk matrix) is a visual that can be used to evaluate and prioritise identified risks. These risk assessment tools are used specifically for assessing three essential factors:

- The likelihood of risks occurring,

- The impact of those risks if they were to occur, and

- The overall risk level for risks when comparing the likelihood + impact

By assessing the likelihood of a risk event in comparison to the potential impact of that risk event, a risk assessment matrix effectively helps organisations better understand the overall probability vs. severity of a risk, with this final figure being the ‘risk level’.

How can you determine the likelihood of a risk occurring?

Risk assessment matrices use either a 5×5 or 3×3 model for determining the likelihood of any potential risk.

The 5×5 model typically covers five different categories of risk, these being:

- Very Low – <10% chance of that risk event occurring.

- Low – 10-40% chance of that risk event occurring.

- Medium – 40-60% chance of that risk event occurring.

- High – 60-90% chance of that risk event occurring.

- Very High – >90% chance of that risk event occurring.

Contrastingly, the 3×3 model is less nuanced and covers three different categories of risk, these being Low, Medium, and High.

5×5 risk assessment matrices are more commonly used as they typically provide more insight into varying levels of risk impact or severity alongside likelihood or probability. The more granular your risk evaluations, the easier it will be for your organisation to confidently prioritise resource investments towards high-priority vs. lower priority risks.

How can you determine the impact of a risk?

If you’re using a 5×5 risk assessment matrix, then your risk impact criteria will also need to include 5 different categories or tiers.

For the purposes of our sample risk assessment matrix, we’ll be using the following 5 different impact categories:

- Negligible – for risks where no serious injury/illness, damage, or financial/environmental impact can be identified.

- Minor – for risks that could potentially cause minor injury, illness, or damage.

- Moderate – for risks that could result in moderate injury, illness, or damage.

- Major – for risks that will likely result in serious injury, illness, or significant damage.

- Catastrophic – for risks that will have fatal consequences (i.e. death/fatalities, permanent disability, permanent environmental damage, and/or business closure).

Benefits of Using a Risk Assessment Matrix

Risk assessment matrices play an important role in ISO audits, supporting internal auditors and compliance officers in understanding the risk factors of all identified non-conformances. By following risk assessment matrices, organisations can also maintain an effective, systemic approach to implementing corrective actions in the short term, and ultimately in identifying and mitigating risks more efficiently over the long term.

Below are just the main benefits of using a risk assessment matrix:

Simplified prioritisation of risks

It’s natural for businesses to have risks – the trick is learning how to organise and prioritise your risks. With a risk assessment matrix, your organisation can easily categorise risks into different likelihood, impact, and overall risk level factors.

From here, risks with a Very Low to Low level rating can be easily deprioritised, leaving your team free to swiftly and effectively resolve High to Very High level risks that signify greater financial, safety, and operational concerns for your business.

Focused risk management strategising

Effective risk management is integral to not only maintaining ISO Certification, but also supporting the longevity of your business. With a risk assessment matrix and accompanying tailored risk management system for your organisation, your team can strengthen your risk mitigation strategising, creating precise solutions that address all identified components of each recorded risk.

Improved risk monitoring

Using a risk assessment matrix to support record-keeping via a risk assessment register means that you can maintain access to real-time updates for your risk management strategies and corrective actions. This access to real-time risk monitoring naturally also strengthens your organisation’s capacity for facilitating continuous improvements, and ultimately keeping your ISO Management Systems current and optimised for your unique business objectives.

How to Make your own Risk Assessment Matrix: Step-by-Step

Creating your own risk assessment matrix is simple and can easily be done using Microsoft Excel, Google Sheets, or even Canva. You can even use ready-made templates, like our risk assessment matrix template included above.

Or, you can even follow the simple step-by-step instructions we’ve included below:

Step 1: Outline your risk criteria

First, determine the criteria by which you’ll be evaluating your risks. For both 3×3 and 5×5 risk matrices, the likelihood (or level of probability) will be measured along the x-axis of your matrix.

This will create a rough table that looks like this:

| Impact | |||||

| Likelihood | Negligible | Minor | Moderate | Major | Catastrophic |

| Very Low | |||||

| Low | |||||

| Medium | |||||

| High | |||||

| Very High | |||||

Step 2: Assess risk levels based on your risk criteria

The next step is to simply fill in your risk assessment matrix based on your defined risk criteria. The key here is to create a visual system that helps you determine the overall priority level of a risk dependent on that risk’s likelihood and perceived impact.

For instance, looking at the below risk assessment matrix, we can ascertain that a risk that has a Very Low likelihood of occurring but will have a Major impact if it does occur intersects on a Medium risk level square, so we know that risk will be a medium-level priority.

Impact | |||||

| Likelihood | Negligible | Minor | Moderate | Major | Catastrophic |

| Very Low | Low | Low | Low | Medium | High |

| Low | Low | Low | Medium | High | High |

| Medium | Low | Medium | Medium | High | High |

| High | Medium | Medium | High | High | Extreme |

| Very High | Medium | Medium | High | Extreme | Extreme |

Step 3: Prioritise your risks using a risk assessment register

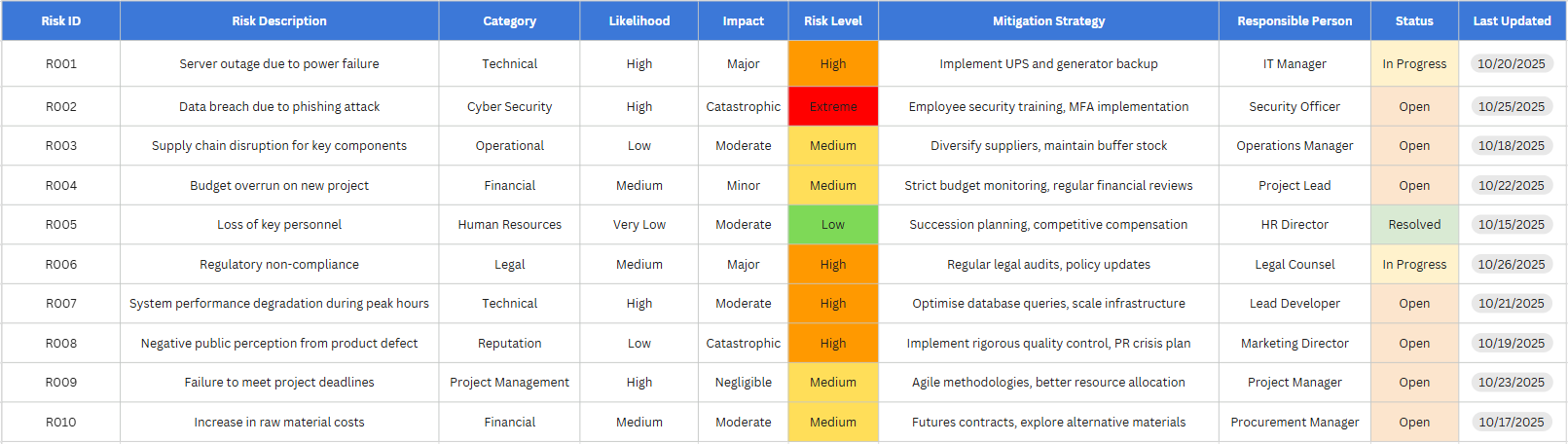

Once you’ve finalised your risk assessment matrix, you can apply your matrix to a risk assessment register, which also typically takes the form of a table, like the one you see below.

Colour-coding your risk assessment register like we’ve done here in this sample register will help you see at a glance which risks are of the highest priority (marked as Extreme) and which risks are the lowest priority (marked as Low).

How to Make your own Risk Assessment Register: Key Components to Include

Your risk assessment register should ideally include the following components used across its columns:

- Risk ID – must be unique to each identified risk for easy record-keeping.

- Risk Description – basic description/definition of risk in laymen’s terms for easy reference across all teams/departments.

- Category – relating to the team/department responsible for managing the risk, and/or relating to a key risk area.

- Likelihood – likelihood of risk occurring, using the system outlined in your risk assessment matrix.

- Impact – the impact your risk will have in the event the risk does occur, using the system outlined in your risk matrix.

- Risk Level – the overall level of your risk when evaluating the likelihood and impact combined, using the system outlined in your risk matrix.

- Mitigation Strategy – potential actions for managing risks in the short term, and mitigating risks over the long term.

- Responsible Person – the member of your team who is accountable for implementing the mitigation strategy (i.e. team leader of that department outlined in your Category column).

- Status – outlining current progress on the implementation of the mitigation strategy.

- Update – last recorded update on the status of the implementation of the mitigation strategy.

Finetune your Risk Assessment Matrix & Processes with our Expert Support

Keep in mind that the risk assessment matrix and register template that we’ve provided in this blog is purely generic and includes example risks. In reality, your company’s biggest business risks are unique to your business and its operations. As such, your risk assessment template should be tailored to meet the operational and regulatory compliance requirements of your organisation.

If you’d like to learn more about how you can effectively tailor your risk assessment matrix to include the right key components, then speak with our team of ISO consultants at S&J Auditing & Consulting. With decades of combined experience making ISO guidelines more accessible for small business owners, our ISO consultants can help you design, develop, and implement ISO compliant risk management systems that support your daily operations and processes, safeguard the health and wellbeing of your staff, and keep you on track to meet all your business goals.

Call 0409 933 447 to speak with a member of our consultation team now, or leave us a web enquiry to request a call from one of our consultants at a time that suits you.